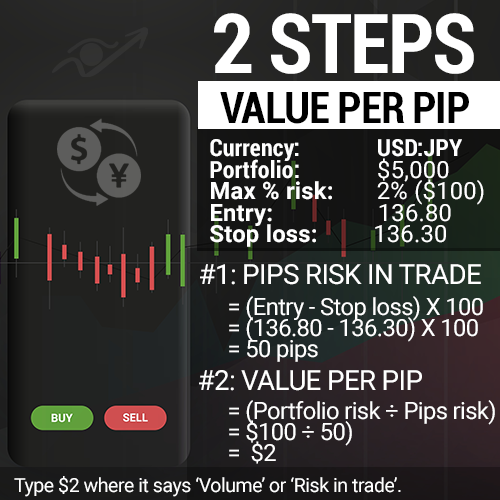

Value Per Pip with Forex Currency pairs – USDJPY

How to find the ‘Value Per Pip’ with the YEN

Here are the trade specifics:

Portfolio size: $5,000

Max risk percentage per trade: 2% ($100)

Trade type: Buy (go long)

Currency pair: USD/JPY

Entry price: 136.80

Stop loss: 136.30

Step 1:

Calculate pips risked in trade

As each pip movement is two decimal places on each currency, you’ll multiply the difference between the entry and your stop loss price by 100.

Here’s the calculation:

Trade risk in pips

= (Entry – Stop loss) X 100

= (136.80 – 136.30) X 100

= 50 pips

This means, you are prepared for the market to move 50 pips away from your entry before you’ll be taken out of your trade for a loss.

Step 2:

Find your ‘value per pip’

‘Value per pip’

= (Portfolio risked per trade ÷ Pips risked in trade)

= ($100 ÷ 50 pips)

= $2

This means, on your trading platform you’ll type in, $2 for where it says ‘Rands risked per pip’, ‘Pip value’ or ‘Volume’, place your entry price at 136.80 and your stop loss price at 136.30 in order to risk $100 of your portfolio.

If you found this useful, I’d like to hear in the comments.

Order via our secured website:

Click here to order The Complete Charts Patterns and Candlesticks Guide by MATI Trader book

Or order via EFT payment”

Click here to order the book via EFT (all info in the invoice).

Enjoy and remember…

You won’t need to buy or order another book on chart patterns and candlesticks ever again as I will be updating it very often and will let you know.

Not sure the best way to get started with MATI Trader?

Follow these steps to start your successful trading journey.