How to take a trade easily with Rand Swiss – Velocity Trader

When I action a trade using Rand Swiss’s – Velocity Trading platform, I need to understand the trading jargon and know how to take a trade.

Here is what it says…

Could you please explain these terms in a layman’s way, so I know what to type in each item?”

~Ivan

ANSWER BY TIMON:

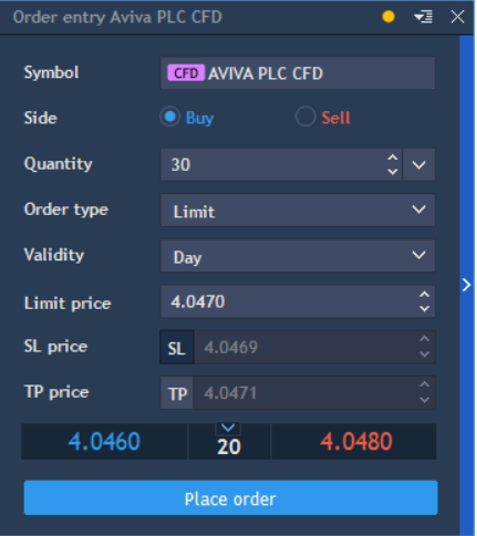

Using the above image, I’ll explain the terms as simply as I can.

Symbol:

Name of financial market

This is the name of the financial market you’ll be trading.

Simply type the symbol in the box to search for it.

Side:

Buy or Sell

This option asks you whether you’ll be buying (going long) or selling (going short) with your trade.

Quantity:

No. of CFDs you’ll buy or sell

This will determine the No. of CFDs you’ll buy or sell in your trade, in order to risk a certain percentage of your portfolio…

NOTE: If you want to calculate the No. of CFDs you’ll buy or sell where you only wish to risk 2% of your portfolio you’ll simply calculate it using this calculation:

No. CFDs to buy/sell = [2% value of portfolio ÷ (Entry – Stop loss)]

Order type:

Market or Limit

There are two order types you can choose from… The Market Price gives you the best current price that the market is trading at. And the Limit Price is where you can choose (limit) the price you would like to buy or sell your trade.

Validity:

How long to keep your trading order in

The Validity is also known as the TIF (Time In Force). This will instruct the broker how long you wish to have your trade order in for…

I personally choose DAY so the order will remain active throughout the day.

I don’t like holding an order overnight as the market can jump the next day which can lead to a bigger risk with your portfolio.

Limit price:

Entry price

The limit price is the actual chosen price you’ll type in whether you wish to buy (go long) or sell (go short) in order to execute your trade.

SL price:

Your protective risk price

The SL price or Stop Loss is a price you’ll type in the trading platform, to protect your portfolio from a big loss.

This is an automated order that will close your position if the market starts moving against your desired direction.

TP price:

Your reward price

The TP price or Take Profit is the opposite of a stop loss price.

This is an automated order that will close your position where you’ll bank a profit or a gain, should the market move in your preferred direction.

Not sure the best way to get started with MATI Trader?

Follow these steps to start your successful trading journey.