Don’t Be A Revenge Loser

So you’re down R2,000 for the day…

Your poor heart strings have been pulled and your ego has been shot down…

In 23 minutes, the stock market will close, which will leave you devastated with a losing trade!

You decide to pump up your chest, make an animal grunt sound and try to make up for this loss…

And so, you take the ‘not-so-perfect trade’, because the market now ‘owes you one’.

You lose again… This time it’s not R2,000, it’s a R4,500 knock.

Well done! You’ve just fallen into the most common Revenge-Trading-Trap…

And you’ve just become what I call a “Revenge-Loser”…

Let’s make sure that never happens again, shall we?

The market doesn’t care about your feelings…

Listen, there are only two types of market environments…

FAVOURABLE – Where the price movements yield high probability trade setups…

UNFAVOURABLE – Where the movements in the market do NOT offer high profitable trade setups…

For example… With my breakout MATI Trader System, I need a market that has broken out of a sideways range in order to ride and profit from it…

If the market stays in the sideways range, and I want to revenge trade… Whether I buy or sell, I will LOSE every time…

That’s why you need to remove the emotions and personal opinions from your analysis COMPLETELY.

The markets have no idea who we are and they don’t care whether we won or lost…

WAKE UP! There is no catch-up

If that revenge is flowing through every inch of your body, and you think you can play catch up – WATCH OUT.

Most revenge losers, will just try to reverse their trading positions and swing the other way…

This is JUST as dangerous for your portfolio…

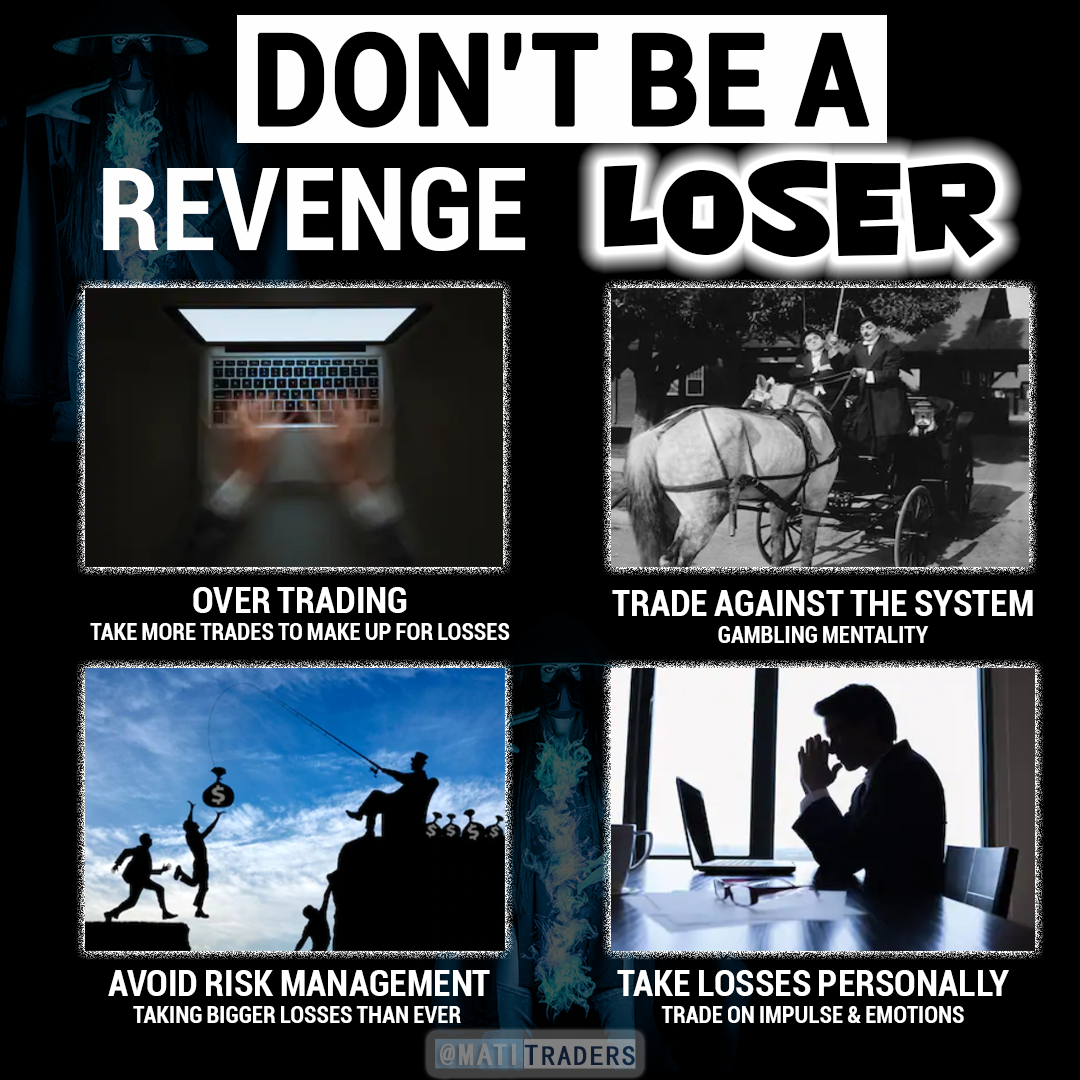

You’re committing three sins when you try to revenge trade…

SIN #1:

You’re going against your proven trading strategy

You’re tempted to trade on impulse rather than following your logical and winning trading system.

SIN #2:

You’re over-trading

This is when you take more trades, to try to feel better about your loss you made…

SIN #3:

You’re trying to play catch-up

This is where you’ll take try to make up for your losses, by just taking trades by chance

You’ll need to stop the revenge trading before it becomes a habit…

2 Solutions to stop you from becoming a ‘revenge-loser’

Solution #1:

Let bygones be bygones

Trade losses come with the territory…

Take them, own them but make sure they are not so big that you feel the need to cry about it…

Drop your risk from 5% down to 2% or even 1% per trade…

Until you get to the point, where you can easily just let your losses slide.

Solution #2:

Grab a cold one

This is my favourite…

When you feel the need to jump on the next trade, without a good setup – the next tip is guaranteed to help.

Step away from your computer and grab a drink, watch Netflix go make Ice-cream… Whatever you need to do, to stop trading for the day – DO IT…

The markets will be here for you tomorrow and for whenever you’re ready to trade again…

Solution #3:

Follow a successful trader

If you feel you:

DON’T want to struggle taking a trade.

DON’T have a trustworthy trading strategy

DON’T have the right experience to know when to buy or sell

DON’T have the time-less money management rules to execute your trades well…

It’s for these reasons and more, I’ve decided to send my personal BUY and SELL weekly trade alerts, tips, videos and market updates for you…

When I send out a trade, you know what I’m buying or selling for the day, week and month…

And when I profit you profit… It’s really a win-win…

Sound good? Click here to find out how…