Is trading a form of gambling?

With hesitance, I would say yes.

However, I would rather call trading a form of strategic gambling as both require elements of risk, reward, strategy and decision making.

In the next two weeks or so, I’m planning to publish a new online FREE book called “Poker Vs Trading”.

Who knows, by the end of it all you may take up professional poker playing as well as trading…

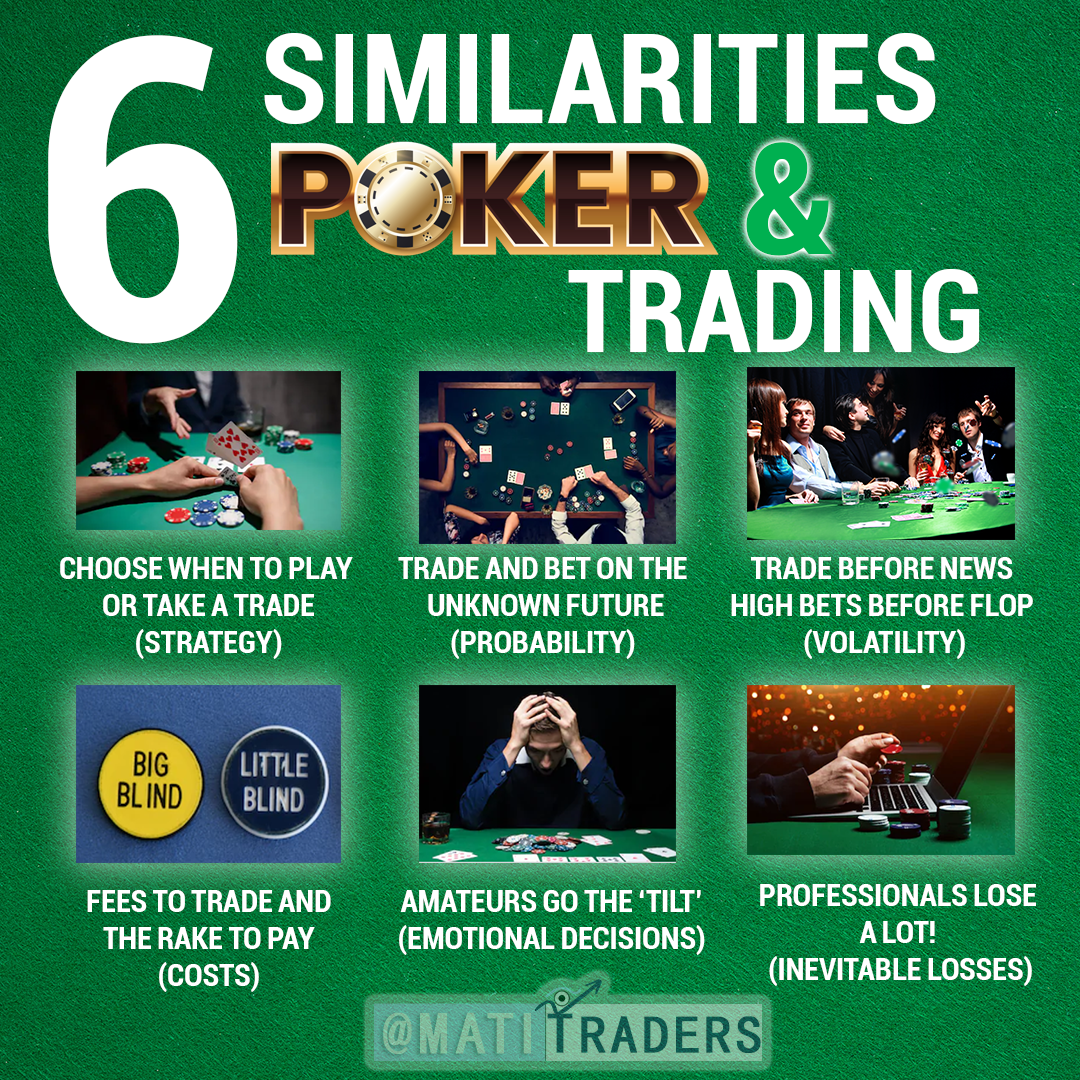

Let’s start with the similarities.

SIMILARITY #1:

We can choose when to play (Strategy)

Traders and poker players don’t play every hand that is dealt to them.

With poker, when a hand is dealt, we can choose to either play the hand, based on how strong it is, or we can choose to fold and wait for the next hand…

With trading, we wait for a trading setup based on the criteria of our strategy i.e. MATI Trader System.

You’ll then have the exact criteria and money management rules to follow in order to take a trade or wait for the next trade.

SIMILARITY #2:

Amateur poker players and traders tend to go the ‘tilt’ (Emotional roller-coaster)

Emotions are a main driver which leads to traders losing their cash in their account or poker players losing their chips very quickly.

With poker, you get players who let their emotions take over where they start betting high with an irrational frame of mind.

These emotions lead them to losing their chips very quickly.

This is when they enter the state of what is called ‘going the tilt’.

With trading, amateur traders also tend to act on impulse and play on gut, instinct, fear and greed after they’ve undergone a losing streak or a winning streak.

This often leads them to:

~ Taking a series of losses.

~ Losing huge portions of their portfolio.

~ Holding onto losing trades longer than they should.

~ Entering a mindset of revenge trading.

SIMILARITY #3:

We know when to hold ‘em and when to fold ‘em (Cut losses quick)

We have the choice to reduce our losses when it comes to betting a hand or taking a trade.

With poker, if the players start upping the stakes and you believe you have a weaker hand in the round, you can choose to ‘fold’ and lose only the cost of playing the ‘ante’.

With trading, if you’ve taken a trade and it turns against you, you have a stop loss which will get you out at the amount of money you were willing to risk of your portfolio…

SIMILARITY #4:

We know the rake (Costs involved)

There are always costs associated with each trade we take or each hand we play, which eats into our winnings.

With poker, it’s the portion of the pot that is taken by the house i.e. the blinds and the antes. With trading, it’s the fees charged by your broker or market maker, in order to take your trade. These fees can be either the tax, spread and/or the brokerage.

SIMILARITY #5:

Aggressive trading and betting before the flop (High volatility)

There will always be a time of strong market moves and high betting.

With poker, you get times where players like to bet aggressively and blindly before the flop is revealed. It’s these times that lead to the amateur poker players losing their chips very quickly.

With trading, you get economic data i.e. Non-Farm-Payrolls, black swan events and Interest Rate decisions when big investors and traders like to drive the market up or down before the news even comes out.

NOTE: I ignore both forms of hype as it is can lead to a catastrophic situation.

SIMILARITY #6:

We bet and trade based on the unknown

Every bet and trade we take and play is based on incomplete information of the future.

With poker, we are dealt hands then bet on decisions based on not knowing what cards our opponents have and/or what is shown on the river.

We then have the options to call, bet, raise or fold during the process.With trading, we take trades based on probability predictions without knowing where the price will end up at.

This is due to new information which comes into the market including (demand, supply, news, economic indicators, micro and macro aspects).

SIMILARITY #7:

We lose A LOT! (Losses are inevitable)

Taking small losses are part of the game with both poker and trading.

With poker, it is important to wait patiently until you have a hand with a high probability of success.

Some of the best poker players in the world, fold 90% of the starting hands, they receive. Some professional poker players can go through weeks and months without a win.

With trading, we can lose over 40% to 50% of the time.

In general, I expect around two losing quarters a year. I know that when there are better market conditions, it will make up for the small losses.

SIMILARITY #8:

You must learn to earn (Education is vital)

You need to understand and gain as much knowledge as you can about poker and trading before you commit any money.

With poker, you need to understand:

• The rules of the game.

• The risk per move.

• The amount of money you should play per hand.

Once you know these points, you’ll be able to develop some kind of game plan with each hand you play.

With trading, you need to understand:

• The MARKET (What, why, where are how?)NB*

• The METHOD (What system to follow before taking a trade).

• The MONEY (Risk management rules to follow with each trade)

• The MIND (The frame of mind you must develop to succeed)

SIMILARITY #9:

Perseverance is the key ingredient to success

You need to take the time and have the determination to become a successful trader and poker player.

With poker, you’ll need to keep at it and apply strict money management rules with each hand played. With trading, you’ll need to know your trading personality, know which trading method best works you and understand your risk profile…

I’ll leave you with a quote from Vince Lombardi (American football player, coach, and executive):

“Practice does not make perfect. Only perfect practice makes perfect”

Do you have any similarities between trading and poker?

Let me know and I’ll add it to my new book “Trading Vs Poker”, and I’ll send it straight to your email address…

You can email me at www.timon@timonandmati.com.